Your browser is not supported by our website. Some features of the site are not available or will not work correctly. See the procedure to update your browser

Responsible investment (RI) represents 50.6% of Canada's investment industrynote1.

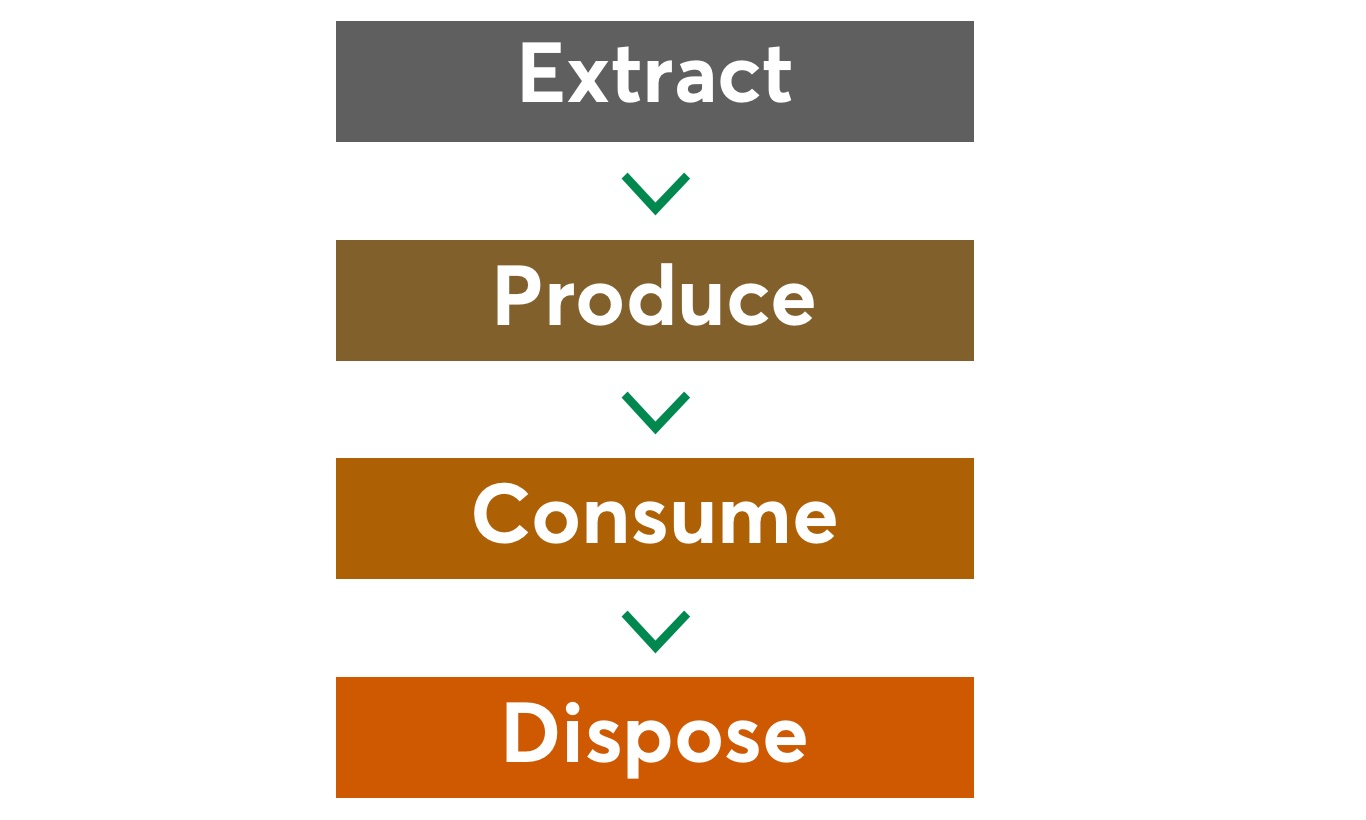

Our economy is based on a linear model of production and consumption. This model has now reached its limit:

The extraction of non-renewable resources is becoming increasingly difficult, onerous and damaging to the environment. Currently, only 19% of residual materials are recycled or composted worldwidenote2. Therefore, it’s not surprising that 85% of Canadians say they are concerned about waste managementnote3.

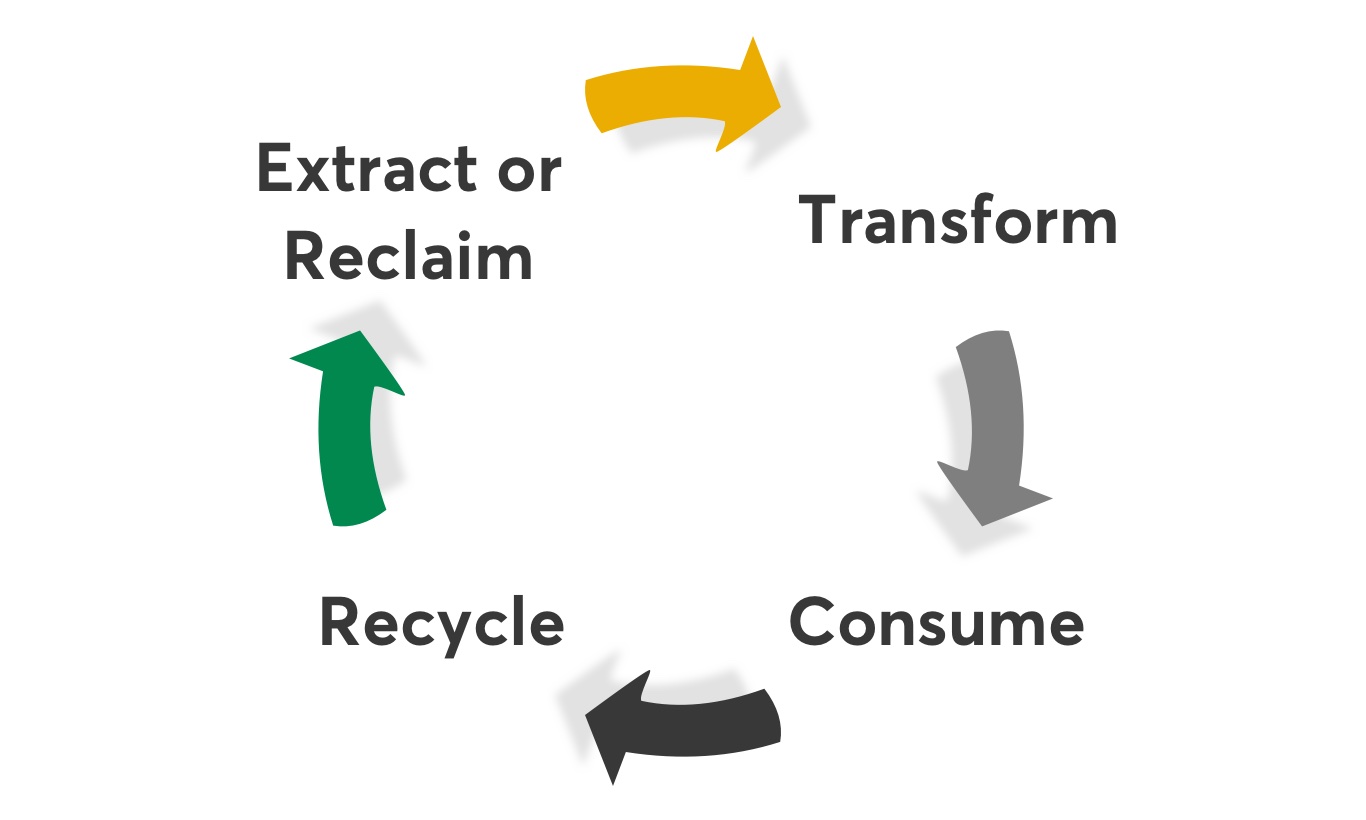

To achieve a sustainable balance, the world’s economy must shift to a circular model that fosters lower resource extraction, optimized resource use, and the reuse, reconditioning and recycling of consumed products.

Many of the companies included in Desjardins Sustainable RI funds are working on their own solutions to these challenges. For example, some of them are developing circular production processes (ecodesign), while others are recycling or reclaiming waste materials.

Company: Lenzingnote3

Lenzing manufactures textile products from cellulose derived from trees.

In addition to using less water and chemical additives compared to cotton production, Lenzing’s closed-loop production process does not generate waste. The company uses 100% of its harvested timber. A portion of the production residue is biorefined and used by the agri-food industry, while the rest is used as an energy source for Lenzing’s facilities. Finally, its fibres are certified as fully compostable.

This company is part of:

Company: Trexnote3

Trex manufactures and distributes construction materials for composite wood decks.

The company uses recycled wood fibre and plastic waste (bags and plastic wrap) and is one of the largest plastic recyclers in the United States. Sustainability is an integral part of the company’s business model. Trex aims to reduce resource use while capitalizing on the financial advantages of its low input costs.

This company is part of:

Company: Waste Connectionsnote3

Waste Connections specializes in the collection and treatment of waste and recyclable materials in Canada and the United States.

The company develops technologies for capturing gas from landfills. Thanks to these technologies, a single site can prevent the emission of 1.2 million tonnes of carbon dioxide over 10 years.

This company is part of:

This information should not be construed as a recommendation to buy or sell the securities, products or services referred to or as the sole basis for an investment decision.

In order to facilitate their accessibility our website may include links to other sites on the Internet. When the links to these sites are used, the rules for the site should be checked and accepted prior to use. We do not accept any responsibility for the content or further functionalities of these sites. Desjardins is not responsible for the content or the subject matter of any other website, including any site that has provided access to its portal or that has been accessed through its portal.

Desjardins Funds are not guaranteed, their value fluctuates frequently, and their past performance is not indicative of their future returns. Commissions, trailing commissions, management fees and expenses may be associated with mutual fund investments. Please read the prospectus before investing. Desjardins Funds are offered by registered dealers.