Your browser is not supported by our website. Some features of the site are not available or will not work correctly. See the procedure to update your browser

Investments that work toward a better world

Our commitment to members, clients and the community has been our key strength for the past 120 years. That’s how we contribute to a better future.

“We’re here so that everyone who trusts us with their finances is able to make their goals and dreams come true.”

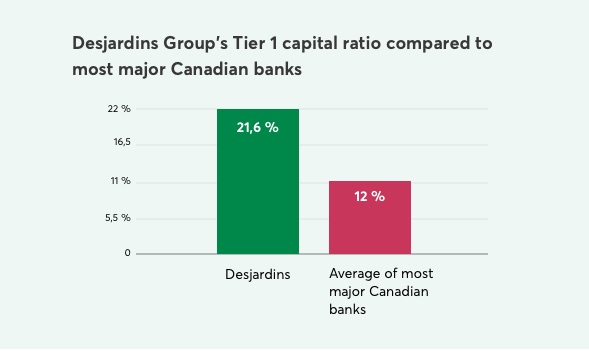

Through the years, we’ve accumulated a total capitalization of more than 25 billion dollars1 contributing to our reputation as one of the world’s strongest financial institutions.

Learn more about our financial strength - External link. This link will open in a new window.

Responsible investment focuses as much on returns as on the environmental, social and governance practices of the companies selected.